how to avoid estate tax in california

You need to create a trust document its similar to a will naming someone to take over as trustee after your death called a successor trustee. For estates that exceed this amount the top tax rate is.

California Estate Tax Everything You Need To Know Smartasset

For example if the taxable estate is 120000 the tax owed would be the 23800 base tax in the 100001 to 150000 bracket plus 30 of the amount over 100000 20000 x.

. Another way to avoid probate in California is through joint ownership. How to Avoid the Estate Tax. Estate planning can be a zealous process but itll likely make your life easier.

Supreme Court and the law was affirmed in Nordlinger v. Fortunately there is also an exemption built into the various tax laws known as the capital gains real estate tax exemption. Similarly the proposed 04 percent wealth tax would only be applicable for those with incomes above.

005 percent of the next 15 million of. California will not assess tax against Social Security benefits like many other states do. After the law was passed the resulting litigation went all the way to the US.

In 1978 the citizens of the State of California voted in an initiative to limit property taxation which is now embodied in Article 13A of the California Constitution Prop 13. However the voter initiative did expand the ability of older adults to move and transfer their property tax basis to a new home in California. 10 hours agoTax rate changes - You are subject to new tax rates due to changes in federal or state tax laws.

For some people a substantial inheritance could result in that persons estate exceeding the lifetime exemption amount meaning they would ultimately owe taxes on their estate. The estate tax is paid out of the estate so the beneficiaries will not be liable for paying the estate tax technically speakingalthough it would deplete the amount left in the estate for distribution. But local assessments can be a little bit lower.

By taking the time to plan and divide your assets draft a will and think about how to avoid estate tax in Canada you can minimize the amount of taxes looming over your familys heads and ensure you leave them with as much inheritance as possible. 2 How to Avoid Inheritance Tax and Capital Gains Tax in California. 1 percent of the next 9 million of estates value.

Joint ownership allows two or more people to own an asset together. If you own it when you die your heirs include the asset in the calculation of your estate and apply the 40 tax to the excess. With the exception of the.

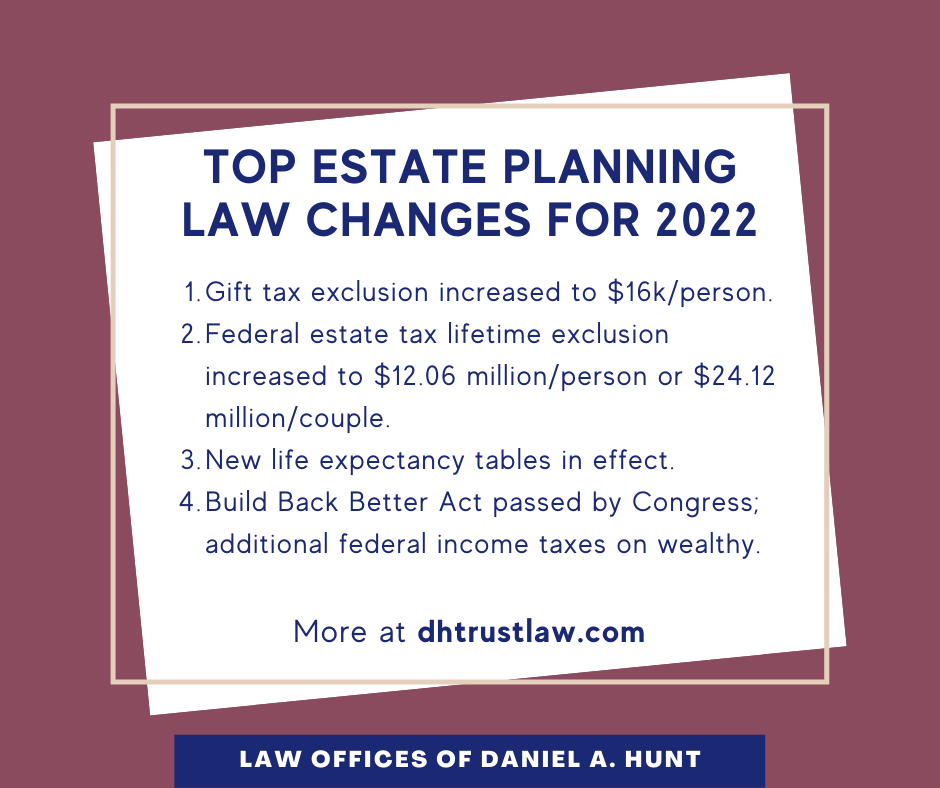

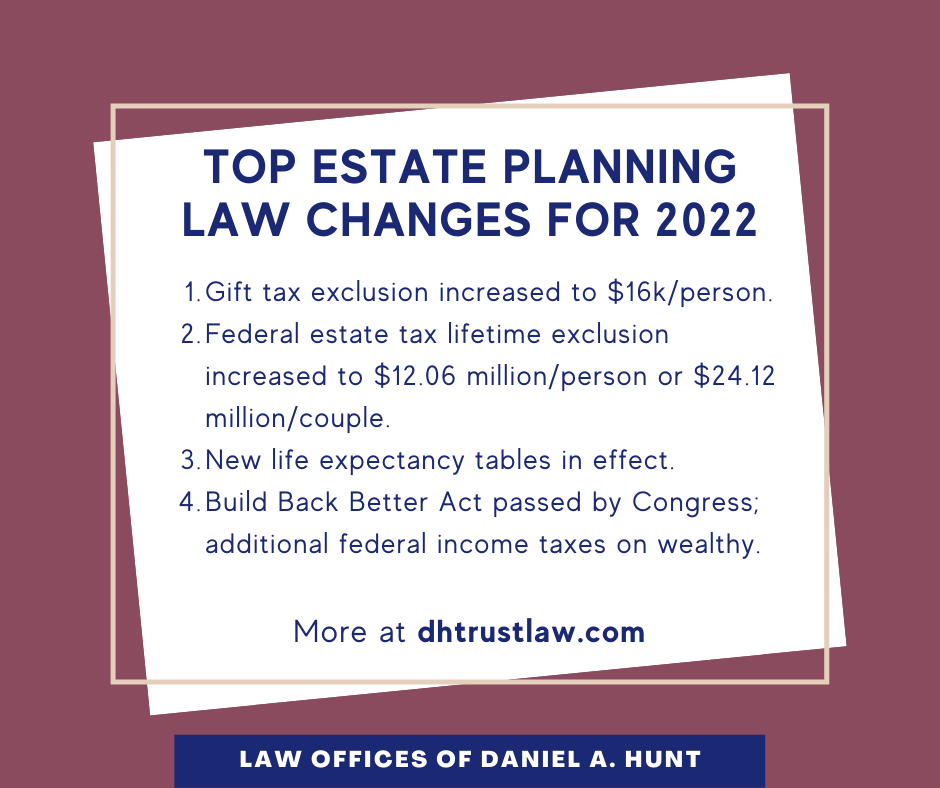

Below we review a number of different ways you can avoid the estate tax if you. Proposition 19 passed in 2020 significantly limited the parent-child exclusion. The federal estate tax goes into effect for estates valued at 1206 million and up in 2022 for singles.

In California these fees are calculated as a percentage of the gross not net value of the assets in the estate. These rates are set out in Probate Code 10800 and 10810 4 percent on the first 100000 3 percent on the next 100000 2 percent on the next 800000 and so on. Thenand this is crucialyou must.

For instance the 133 percent income tax bracket applies to a net income over 1 million. Number of Inherited Properties Likely to Grow. I currently still have my Nevadas DL because I use to live in Nevada about a 15 years ago.

In each tax bracket the estate pays a base tax plus the applicable rate on the income that falls within that bracket. According to Californias probate law the executor compensation schedule in the state is as follows. 4 percent of the first 100000 of estates value.

California does not levy an estate tax on any estates regardless of size. New tax rates may impact your overall tax due. Estate tax is calculated based on the net value of all the property owned by an individual at the date of their death.

This clause in the tax law allows 250000 per taxpayer per tax year. California Estate Tax. Even though California wont ding you with the death tax there are still estate taxes at the federal level to consider.

The current exemption amount is 545 million. In California the measure Proposition 19 will reduce the cost of moving for retirees or homeowners with older families. The easiest thing to do is to give money away.

In California you can make a living trust to avoid probate for virtually any asset you ownreal estate bank accounts vehicles and so on. For a married couple filing jointly the. A property tax base transfer for California properties with a market value of up to 750000 is set to take effect starting April 1 2021.

Ad From Fisher Investments 40 years managing money and helping thousands of families. The Probate Process ExplainedHow To Probate An Estate If you already have the right or have probate as an executor or administrator you can start dealing with the estate. Up to 25 cash back Living Trusts.

As you might expect most people arent exactly thrilled at the proposition of paying estate taxes after their death. 40 on taxable amount. The share of homeowners over 65 increased from 24 percent in 2005 to 31 percent in 2015.

Probate or the legal process that happens after someone has died can and. The exemption can essentially equal 250000 for a single person and a married person filing separately. 2 percent of the next 8000000 of estates value.

Gift Money To Your Kids. How to Change Your Withholding To change the amount of Arizona income tax withheld you must complete Arizona Form A-4 and submit it to your employer to choose a different withholding percentage option. How does the taxes work for me in this case and how do I avoid the California State tax when I get the 125m.

Access Free How To Probate An Estate In California Estate Planning. For a home owned this long the inheritance exclusion reduces the childs property tax bill by 3000 to 4000 per year. This tax has full portability for married couples meaning if the right legal steps are taken a married couple can avoid paying an estate tax on up to 2406 million after both have died.

24 Disclaim the inheritance altogether. However an estate must exceed 1158 million dollars per person in 2020 to be subject to estate tax in the US. You may need to apply for the right to deal with the estate of the person who.

The LOI is expected to be received on the 2nd week of Feb. The estate tax applies to your assets in excess of the exemption amount. The anticipated hike would raise the rates to 143 on incomes over 1 million 163 on incomes over 2 million and 168 on incomes over 5 million.

22 Make the property your primary residence. California property owners are getting older. And they have 45 days to finalize the sale.

Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Some clients decide to disclaim an inheritance in order to avoid the potential of owing estate taxes when they die. 23 Defer your taxes as an investment property.

When one owner dies the surviving owner s automatically becomes the sole owner of. California tops out at 133 per year whereas the top federal tax rate is currently 37. When planning estate transfers or your own retirement its understandable that property taxes arent top of mind.

The base tax rate is one of the highest in the country. California does have a state sales tax which can range from approximately 7 to 10. 21 Sell the property as fast as you can.

In contrast an inheritance tax is calculated based on the value of bequests or property given by will received from a deceased persons estate. In turn there are a number of strategies you can use to minimize what you owe or avoid estate taxes altogether. 3 percent of the next 100000 of estates value.

California Estate Tax Everything You Need To Know Smartasset

Exploring The Estate Tax Part 2 Journal Of Accountancy

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

California Estate Tax Everything You Need To Know Smartasset

Top Estate Planning Law Changes For 2022 Law Offices Of Daniel Hunt

Top 4 Gift And Estate Tax Avoidance Strategies Estate Tax Estate Planning Estate Planning Attorney

Taxes On Your Inheritance In California Albertson Davidson Llp

Is Inheritance Taxable In California California Trust Estate Probate Litigation

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

How Could We Reform The Estate Tax Tax Policy Center

How To Avoid Estate Taxes With A Trust

How To Avoid Estate Taxes With A Trust

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Breaking Down The Oregon Estate Tax Southwest Portland Law Group

5 Ways The Rich Can Avoid The Estate Tax Smartasset

How To Avoid Estate Tax For Ultra High Net Worth Family

States With No Estate Tax Or Inheritance Tax Plan Where You Die